The 8-Minute Rule for Kam Financial & Realty, Inc.

Table of ContentsNot known Incorrect Statements About Kam Financial & Realty, Inc. Not known Incorrect Statements About Kam Financial & Realty, Inc. Our Kam Financial & Realty, Inc. DiariesThe Ultimate Guide To Kam Financial & Realty, Inc.Kam Financial & Realty, Inc. Things To Know Before You BuyKam Financial & Realty, Inc. Fundamentals Explained

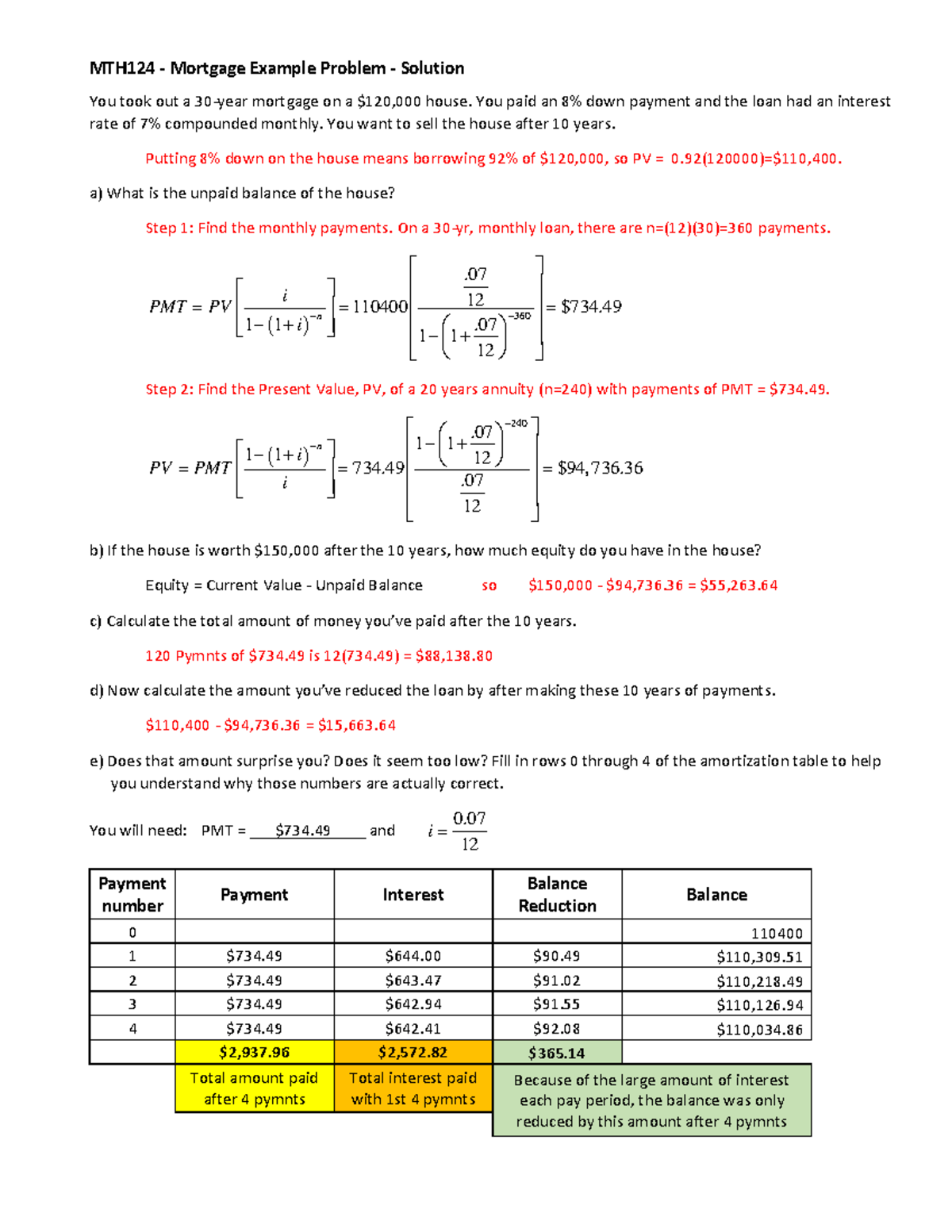

A home loan is a funding used to purchase or preserve a home, plot of land, or various other real estate. The borrower agrees to pay the lender in time, generally in a collection of routine settlements separated into major and passion. The residential property then functions as security to safeguard the lending.Mortgage applications undergo an extensive underwriting procedure before they get to the closing stage. The property itself serves as collateral for the finance.

The cost of a mortgage will certainly depend on the sort of funding, the term (such as three decades), and the interest rate that the loan provider fees. Home mortgage rates can differ commonly depending on the sort of item and the certifications of the candidate. Zoe Hansen/ Investopedia People and services use mortgages to acquire property without paying the entire acquisition cost upfront.

An Unbiased View of Kam Financial & Realty, Inc.

A lot of conventional home loans are fully amortized. Normal mortgage terms are for 15 or 30 years.

A property buyer pledges their residence to their lending institution, which after that has an insurance claim on the home. This makes certain the lending institution's interest in the building must the customer default on their monetary commitment. When it comes to foreclosure, the lender might kick out the citizens, market the home, and utilize the cash from the sale to pay off the home mortgage financial obligation.

The lending institution will certainly ask for proof that the debtor can settling the funding. This might consist of bank and financial investment declarations, current tax obligation returns, and evidence of present employment. The loan provider will usually run a credit check as well. If the application is accepted, the lender will use the borrower a funding of up to a specific quantity and at a specific rates of interest.

Facts About Kam Financial & Realty, Inc. Revealed

Being pre-approved for a mortgage can give buyers a side in a tight housing market because sellers will certainly understand that they have the money to support their deal. Once a buyer and seller settle on the regards to their offer, they or their agents will meet at what's called a closing.

The vendor will certainly move possession of the residential property to the customer and receive the agreed-upon amount of cash, and the customer will authorize any kind of remaining mortgage records. There are hundreds of choices on where you can obtain a mortgage.

The smart Trick of Kam Financial & Realty, Inc. That Nobody is Talking About

The basic kind of home mortgage is fixed-rate. A fixed-rate home loan is also called a traditional home loan.

Getting The Kam Financial & Realty, Inc. To Work

:max_bytes(150000):strip_icc()/collateral-9d1d0360292b4a06989957c5e3239fb5.jpg)

The entire loan balance becomes due when the customer passes away, moves away completely, or offers the home. Factors are basically a cost that debtors pay up front to have a lower interest rate over the life of their car loan.

Kam Financial & Realty, Inc. - Truths

Just how much click site you'll need to pay for a home loan depends upon the kind (such as repaired or adjustable), its term (such as 20 or three decades), any type of price cut factors paid, and the rates of interest at the time. mortgage loan officer california. Rates of interest can differ from week to week and from loan provider to lending institution, so it pays to search

If you default and foreclose on your home loan, nevertheless, the financial institution might become the new proprietor of your home. The price of a home is commonly far higher than the quantity of cash that many houses save. Consequently, home loans allow people and families to buy a home by placing down just a fairly little down payment, such as 20% of the purchase cost, and getting a finance for the balance.

:max_bytes(150000):strip_icc()/standing-mortgage.asp_Final-f243f07e8a22431ba1a4c32616f127a2.jpg)